Tax Free Savings Account

Introduced in January 2009, members have another option when saving money with the Tax-Free Savings Account (TFSA). You can save or invest money without paying tax on the income it earns and you can also withdraw it tax free. Canadians now have flexible account options for a lifetime of savings needs.

To help you understand the TFSA better, we've attached a guide to understanding the TFSA here, and put together some Frequently Asked Questions (FAQs) based on the government’s information, which you will find below.

Our professional staff are focused on you and your individual needs. Contact us today to see how we can help you.

Frequently Asked Questions:

What is the Tax Free Savings Account

Who is eligible to open a TFSA?

How would I know what my TFSA contribution room is for a given tax year?

If I don't have the money to invest in a given year, would I be able to use any unused contribution room in a future year?

How much can you contribute to a TFSA per year?

What is the main benefit of saving in a TFSA?

Would there be any restrictions on withdrawals?

How can the TFSA help me with my savings need through my lifetime?

What kind of investments can you hold in a TFSA?

What kinds of investments are prohibited for the TFSA?

What if I contribute excess amounts in my TFSA?

How are TFSAs taxed?

What if I borrow to invest in my TFSA?

Could I use my TFSA assets as security for a loan?

Can I give my spouse or partner funds to contribute to a TFSA?

What is the effect on income-tested government benefits?

What happens upon death?

What happens upon separation or divorce?

What if you become a non-resident?

How is a TFSA different from a Registered Retirement Savings Plan (RRSP)?

How does the TFSA compare to other registered savings vehicles?

Where can I find more information?

What is the Tax Free Savings Account?

The TFSA is a registered savings account that allows taxpayers to earn investment income tax-free inside the account. Contributions to the account are not deductible for tax purposes, and withdrawals of contributions and earnings from the account are not taxable.

TFSA savings can be used for a variety of needs, for example: to purchase a new car, renovate a house, start a small business or take a family vacation.

Top

Who is eligible to open a TFSA?

Any individual (other than a trust) who is a resident of Canada and 18 years of age or older would be eligible to establish a TFSA. The only requirement will be that the individual must have a Social Insurance Number when the account is opened. There will be no limit on how many TFSAs each person can set up, keeping in mind that the allowable yearly tax-free contribution is a combined total of all of these accounts.

Top

How would I know what my TFSA contribution room is for a given tax year?

The Canada Revenue Agency will determine TFSA contribution room (based on information provided by issuers) for each eligible individual who files an annual T1 individual income tax return.

Individuals who have not filed returns for prior years (because for example, there was no tax payable) would be permitted to establish their entitlement to contribution room by filing a return for those years or by other means acceptable to the .

Top

If I don't have the money to invest in a given year, would I be able to use any unused contribution room in a future year?

Yes, the 2008 budget proposes no limit on the number of years unused contribution room could be carried forward.

Top

How much can you contribute to a TFSA per year?

Each year you could contribute an amount up to your contribution room for the year. The TFSA contribution room will be determined by the for each eligible individual who files an annual income tax return.

Your contribution room would be made up of three amounts:

- First: Each year you would be allocated and allowed to contribute at least $5,000 (this annual amount will be indexed to inflation and rounded to the nearest $500 on a yearly basis).

- Second: Any withdrawals made during the year would be added to the contribution room for the next year.

- Third: Any unused contribution room from the previous year would be added to the contribution room for the year.

For example (assuming no indexing):

- In 2009 you would be allocated and allowed to contribute up to $5,000. If you only contribute $2,000, an amount of $3,000 would be carried forward to 2010.

- Your contribution room for 2010 would then be $5,000 plus $3,000, or $8,000.

- If in 2010, you do not contribute but decide to withdraw $1,000, your contribution room for 2011 would be $5,000, plus $8,000 (carried forward from 2010), plus the $1,000 withdrawn, or $14,000.

Top

What is the main benefit of saving in a TFSA?

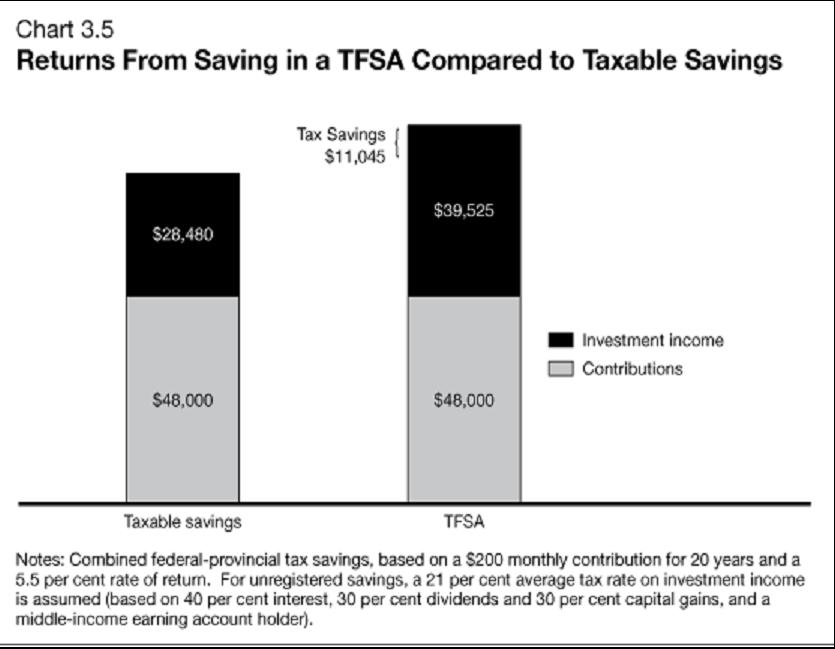

Because capital gains and other investment income earned within a TFSA will not be taxed, an individual contributing $200 a month to a TFSA for 20 years will accumulate about $11,045 more in savings than if the investment had been made in a taxable savings vehicle (unregistered account).

Note: Combined federal-provincial tax savings, based on a $200 monthly contribution for 20 years and a 5.5% rate of return. For unregistered savings, a 21% average tax rate on investment income’s assumed (based on 40% interest, 30% dividends and 30% capital gains, and a middle-income earning account holder).

Would there be any restrictions on withdrawals?

No, you could withdraw any amount in the account for any reason.

Top

How can the TFSA help me with my savings need through my lifetime?

All Canadians have a reason to save to fulfill important lifetime goals and aspirations.

- As you begin to work, you are able to contribute $100 a month to your TFSA. By age 25, you have accumulated $12,000—enough to purchase your first car for $10,000.

- You continue to save in your TFSA to finance other major purchases: a down payment on a new home, a home renovation to make it larger, a child’s wedding and then an RV to enjoy in retirement.

- By saving regularly in a TFSA throughout your life, you will be able to finance these purchases and still accumulate about $135,000 by the time you are 80. This is about $40,000 more than you would have accumulated had you saved on an unregistered basis.

What kind of investments can you hold in a TFSA?

A TFSA would generally be permitted to hold the same investments as a registered retirement savings plan, such as:

- GICs, term deposits, high-interest savings accounts

- mutual funds

- shares

- bonds, debentures, notes, mortgages

Where a TFSA holds a non-qualified investment, a tax of 50% of the fair market value (FMV) of the non-qualified investment will be applied.

Top

What kinds of investments are prohibited for the TFSA?

You are not permitted to invest in entities where you do not deal at arm’s length. Where a TFSA holds a prohibited investment, a tax of 50% of the fair market value (FMV) of the prohibited investment will be applied.

Top

What if I contribute excess amounts in my TFSA?

Similar to an RRSP, excess contributions to a TFSA will be subject to a 1% per month penalty tax until withdrawn.

Top

How are TFSAs be taxed?

The big advantage to the TFSA is that any income and gains on investments held within it will not be taxed either while held in a TFSA or upon withdrawal, hence the name – Tax-Free Savings Account.

Top

What if I borrow to invest in my TFSA?

Since the income earned inside a TFSA along with TFSA withdrawals are non-taxable, you won’t be able to write off any interest expense on funds borrowed for the purpose of investing in a TFSA.

Top

Could I use my TFSA assets as security for a loan?

Unlike RRSPs, which cannot be used as collateral for a loan (unless you want your RRSP deregistered and immediately taxed), TFSA assets can be used as collateral. This may facilitate investors in obtaining secured credit at more favorable rates.

Top

Can I give my spouse or partner funds to contribute to a TFSA?

Normally, the attribution rules contained in the Income Tax Act block attempts at splitting either income or capital gains between spouses or partners by attributing such income or gains back to the original spouse or partner.

The federal budget introduces an exception to the attribution rule stating that the rules will not apply to any income or gains earned in a TFSA derived from a spouse or partner’s contributions.

Top

What is the effect on income-tested government benefits?

One of the biggest criticisms of the current RRSP system is that when funds are withdrawn upon retirement, not only are they taxed at the retiree’s marginal tax rate, but in many cases the withdrawals affect the retiree’s eligibility for income-tested government benefits and credits. These may include the Age Credit, the Guaranteed Income Supplement or even Old Age Security (OAS) benefits.

The Government of Canada announced that since withdrawals from the TFSA are not considered to be “income,” they will have no impact on government benefits or credits, such as GIS or OAS, or on the Canada Child.

Top

What happens upon death?

The fair market value of the TFSA on the date of death will be received by the estate on a tax-free basis, but an income or gains accruing after the date of death will be taxable.

Individuals will be able to name a surviving spouse or partner as a “successor account holder”, in which case the TFSA will continue to be tax-exempt. Alternatively, the assets of a deceased individual’s TFSA can be transferred to a surviving spouse or partner’s own existing TFSA contribution room.

Top

What happens upon separation or divorce?

On the breakdown of a marriage or a common-law partnership, any amount from the TFSA of one spouse or partner can be transferred to the TFSA of the other while maintaining the tax-exempt status. Note that the transfer will not re-instate the contribution room of the transferor spouse or partner, nor will it be counted against the contribution room of the transferee spouse or partner.

Top

What if you become a non-resident?

If you become a non-resident, you can still hold your TFSA and continue to benefit from the tax exemption on investment income and withdrawals, however:

no contributions may be made to the TFSA, and

TFSA contribution room will not accumulate while you are a non-resident.

Top

How is a TFSA different from a Registered Retirement Savings Plan (RRSP)?

An RRSP is primarily intended for retirement. The TFSA is like an RRSP for everything else in your life. Both plans offer tax advantages, but they have key differences.

- Contributions to an RRSP are deductible and reduce your income for tax purposes. In contrast, your TFSA contributions will not be deductible.

- Withdrawals from an RRSP are added to your income and taxed at current rates. Your TFSA withdrawals and growth within your account will not—they will be tax-free.

While the two plans are meant to be tax-neutral (see chart below), RRSPs will tend to be the better choice when the tax rate upon withdrawal is expected to be lower than the tax rate upon original contribution. Conversely, TFSAs will make more sense if your tax rate (including the effect of RRSP withdrawals on reduced income-tested benefits) will be higher upon ultimate withdrawal than it was when you contributed.

The after-tax rates of return on TFSA and RRSP savings are equivalent when effective tax rates are the same at the time of contribution and withdrawal: the value of the tax deduction available for RRSP contributions is equivalent to the value of withdrawing funds from a TFSA on a tax-free basis. The rate of return from saving in either a TFSA or an RRSP is superior to unregistered saving (sav).

|

|

TFSA |

RRSP |

Non-Registered Savings |

|

Pre-tax income |

$ 1,000 |

$1,000 |

$1,000 |

|

Tax rate (40%) |

(400) |

N/A |

400 |

|

Net contribution1 |

$ 600 |

1,000 |

600 |

|

5.5% for 20 years |

1,151 |

1,918 |

707 |

|

Gross proceeds |

1,751 |

2,918 |

1307 |

|

Tax at withdrawal 40% |

- |

(1,167) |

-- |

|

Net proceeds |

$ 1,751 |

$1,751 |

$1,307 |

|

Net annual after-tax rate of return |

5.5% |

5.5% |

4% |

Note 1: Forgone consumption (saving) is $600 in all cases. In the RRSP case, the person contributes $1,000 but receives a $400 reduction in tax, thereby sacrificing net consumption of $600.

Top

How does the TFSA compare to other registered savings vehicles?

The introduction of the TFSA will complement existing registered savings plans such as RRSPs and Registered Education Savings Plans (RESPs).

|

Savings Need |

RRSP |

RESP |

TFSA |

|

Education |

Withdrawals of up to $20,000 allowed under the Lifelong Learning Plan (amounts included in income if not repaid) |

Primary purpose of plan Contributions attract grants of 20% or more up to $7,200 |

Contributions not deductible; neither investment income nor withdrawals included in income; withdrawals can be used for any purpose; withdrawals generate new contribution room Investment earnings and withdrawals will not affect eligibility for GIS or other federal income-tested benefits and credits Provides savings vehicle to meet any on-going savings needs |

|

Home ownership |

Withdrawals of up to $20,000 allowed under the Home Buyers’ Plan (amounts included in income if not repaid) |

Not intended for these purposes |

|

|

General purpose, pre-retirement |

Intended for retirement, although withdrawals allowed at any time Withdrawals included in income |

|

|

|

Retirement |

Primary purpose of plan Allows tax-deferral on savings over working years (i.e. contributions deductible, investment income accrues tax-free) Withdrawals included in income and taken into account for purposes of GIS and other federal income-tested benefits and credits |

|

|

|

General purpose, post-retirement |

Accumulated savings must be drawn down after age 71 |

|

Where can I find more information?

-

The government TFSA calculator can help you see how much money you could save.

-

The government’s TFSA website: http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/tfsa-celi/menu-eng.html

Note: The content herein is not intended to provide specific tax advice and should not be relied upon in this regard. Please consult your tax advisor to find out which strategies suit your tax situation. Coastal Financial Credit Union makes no guarantee, representation, or warranty and accepts no responsibility or liability as to the tax treatment of these services.