Your Member ID is the new, 9-digit number you will need to log into online and mobile banking to access your personal accounts. You can find your Member ID in the letter which was mailed out to you ahead of our system upgrades.

If you have misplaced your letter or did not receive one, please contact us or visit your nearest branch.

System Upgrade FAQ

With our online, mobile, and in-branch banking upgrades complete, our team continues to work closely with members as they transition to the new system. Learn about items we are tracking and get answers to commonly asked questions.

Online & Mobile Banking FAQ

Find the answers to some of the most common questions related to online and mobile banking we are currently receiving.

For Personal Members

What is a Member ID and where can I find it?

How do I log into online and mobile banking?

Before attempting to log into online and mobile banking, you will need to remove any memorized accounts, if applicable. Next, enter your new, 9-digit Member ID number and your existing Personal Access Code (PAC) to log in.

I have memorized accounts. How do I remove them?

For mobile devices, such as a tablet or smartphone, simply delete the credit union mobile banking app on your device and download the newest version from your device's app store.

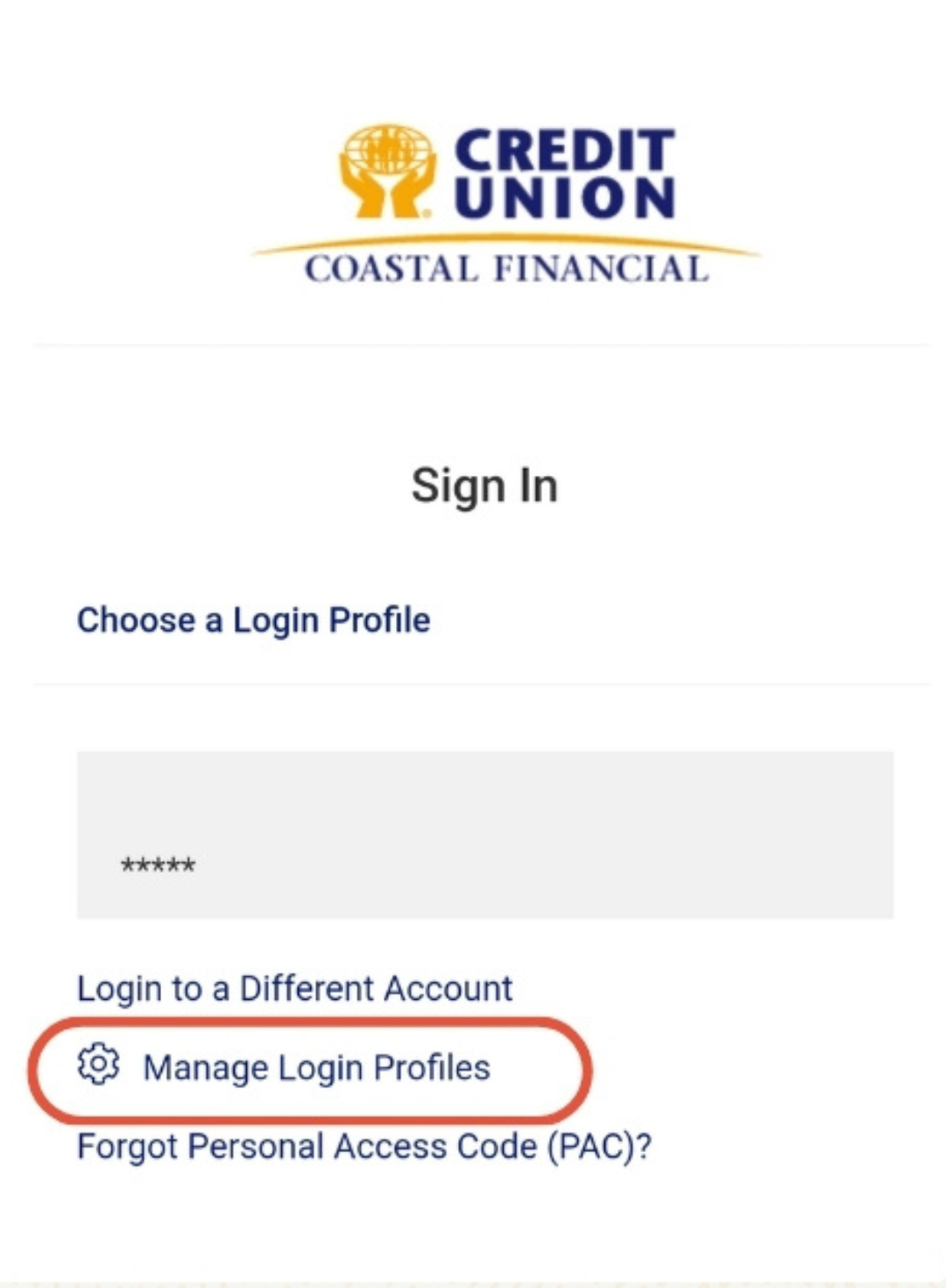

To remove memorized accounts in online banking, go to Manage Login Profiles and delete the saved profile(s).

To remove memorized accounts in online banking, go to Manage Login Profiles and delete the saved profile(s).

I used my new Member ID and existing PAC but still can't login. Who can help?

If you have attempted to use your new, 9-digit Member ID and existing personal access code (PAC), but cannot successfully log into online or mobile banking, please contact us or visit your nearest branch and one of our friendly staff members can assist you.

What happens if I'm locked out?

For security purposes, if you have made three unsuccessful attempts to log into online or mobile banking, your account will be locked for 24 hours. Once the lockout period expires, please confirm your Member ID and personal access code (PAC) by contacting us or visiting your nearest branch before attempting to login again.

For Business and Organization Members

What is a Group Member ID and where can I find it?

Your Group Member ID is the new, 11-digit number you will need to log into online and mobile banking to access your business or organization's accounts. Group Member IDs for your business/organization can be found in the letter which was mailed to the primary business owner on your account.

If you did not receive your Group Member ID information from the primary account holder, please reach out to them directly or contact us.

If you did not receive your Group Member ID information from the primary account holder, please reach out to them directly or contact us.

How do I log into online and mobile banking?

Before attempting to log into online and mobile banking, you will need to remove any memorized accounts, if applicable. Next, enter your new, 11-digit Group Member ID number and your existing Personal Access Code (PAC) to log in.

I have memorized accounts. How do I remove them?

For mobile devices, such as a tablet or smartphone, simply delete the credit union mobile banking app on your device and download the newest version from your device's app store.

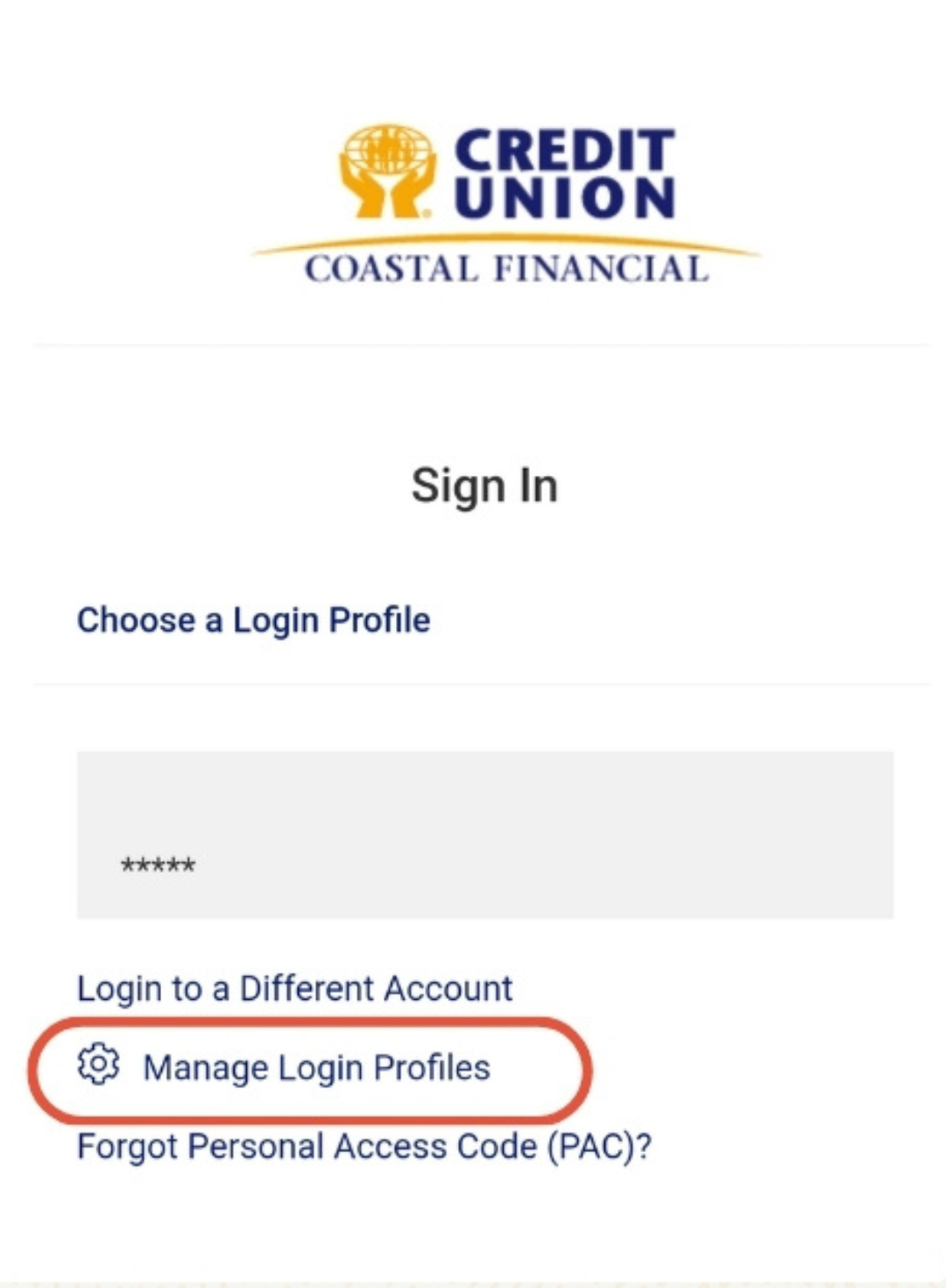

To remove memorized accounts in online banking, go to Manage Login Profiles and delete the saved profile(s).

To remove memorized accounts in online banking, go to Manage Login Profiles and delete the saved profile(s).

I used my new Group Member ID and my existing PAC, but still can't log in. Who can help?

If you have attempted to use your new, 11-digit Group Member ID and existing personal access code (PAC), but cannot successfully log into online or mobile banking, please contact us or visit your nearest branch and one of our friendly staff members can assist you.

What happens if I'm locked out?

For security purposes, if you have made three unsuccessful attempts to log into online or mobile banking, your account will be locked for 24 hours. Once the lockout period expires, please confirm your Member ID and personal access code (PAC) by contacting us or visiting your nearest branch before attempting to login again.

Learn more about our upgrades

Check our our Member Information Insert for a full list of post-upgrade activities to help get you set up for online and mobile banking success.

Select Image

Looking for additional support?

We're here to help. For questions or further support, please reach out to us at (902) 742-7322 or visit your nearest branch.

Select Image